Verified Intelligence for Global Trade

Auctora Analytica™ delivers institutional-grade intelligence, verified trade insights, and strategic market guidance for investors, corporates, and government partners across the UAE and Europe.

We turn complex market, regulatory, and commodity movements into clear actions, while supporting both foreign investors entering the UAE and UAE businesses expanding into Europe.

From commodities and energy to business setup, compliance, and cross-border advisory, we provide the clarity and confidence clients need before commitment.

Beyond reports.

Real intelligence.

Unmatched Access Across Sectors

From energy and commodities to real estate, infrastructure, and investment, our analysts deliver deep regional intelligence backed by international research standards.

Strategic Foresight, Delivered

We don’t just report trends, we anticipate them, helping UAE-based clients identify emerging opportunities before they reshape the market.

We draw on insights from a market of over 1.4 million registered companies in the UAE, keeping us right at the centre of the region’s business landscape.

Trusted Intelligence.

Verified in the UAE.

We deliver precision analysis and verified data to help you operate with confidence across the Emirates and beyond.

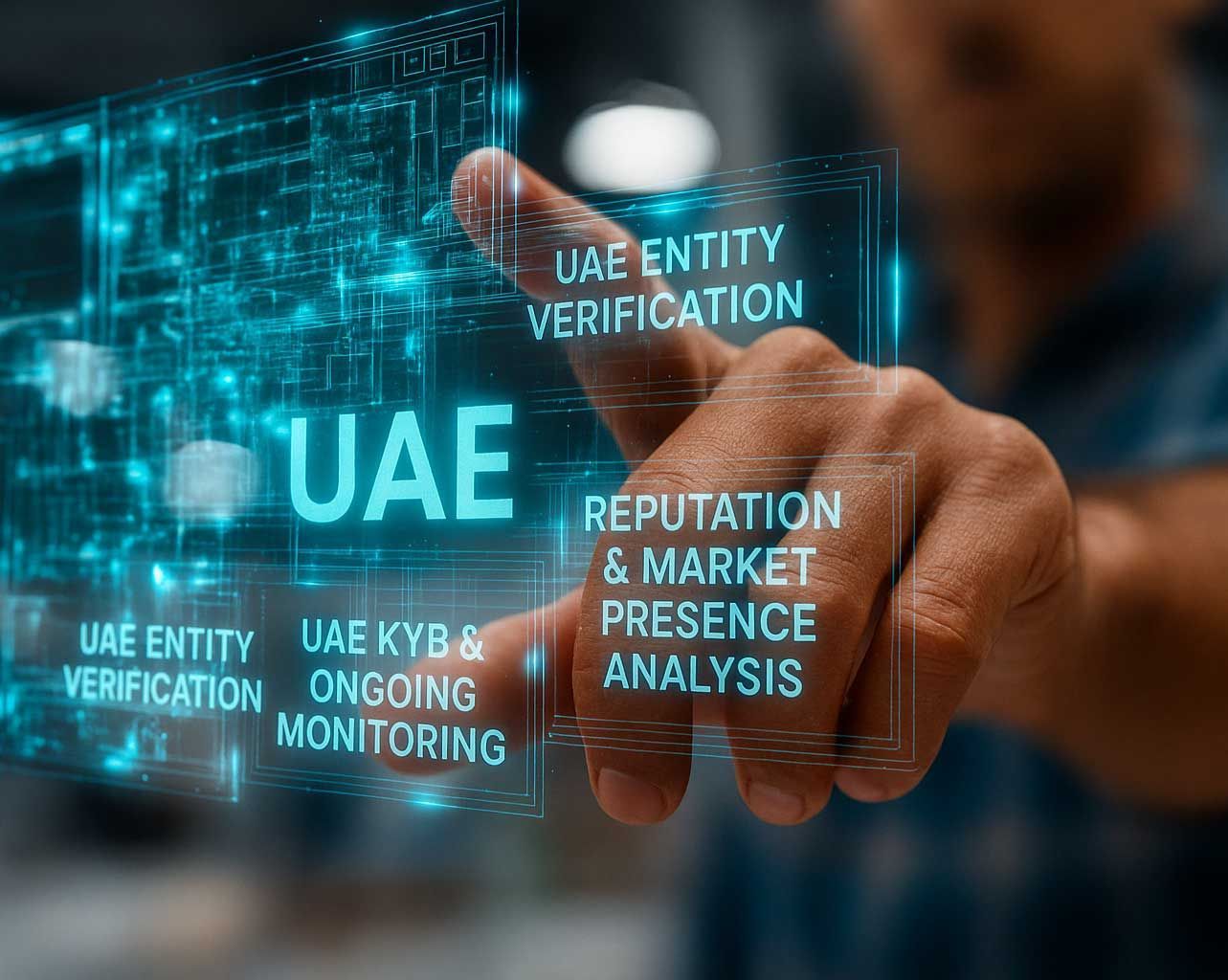

UAE Entity Verification

Verify company legitimacy through official UAE registries, licensing authorities, and compliance databases to ensure every partner or counterparty you engage with is fully verified and trustworthy.

UAE KYB & Ongoing Monitoring

Stay compliant with continuous Know Your Business (KYB) monitoring that tracks ownership, financial activity, and status updates in real time for full operational transparency.

Reputation & Market Presence Analysis

Assess corporate credibility and brand reputation through detailed media screening, market sentiment tracking, and public-domain intelligence to understand true market standing.

UAE Company Credit & Financial Analysis

Gain a verified financial snapshot of UAE-registered companies through trusted data, official records, and key performance insights that reveal long-term stability and growth potential.

Reputation & ESG Review

Evaluate business ethics, governance standards, and sustainability performance through independent ESG reviews that strengthen credibility and align with modern investment requirements.

UAE Company Setup

& Executive Visa Services

About us

Auctora Analytica™ provides data-driven intelligence and verification solutions for global investors, brokers, and corporates operating across the UAE and international markets.

We connect insight with action — combining verified data, regional knowledge, and international compliance standards to help clients make informed, confident decisions

What sets us apart

Verified intelligence. Regional expertise. Global standards.

01

Data-Led, Ethically Driven

Every insight is derived from verifiable data, not speculation, maintaining full transparency across our reporting system

02

Global Perspective, Local Sovereignty

We operate from the UAE’s innovation hub, delivering clarity that bridges regional depth with global perspective.

03

Integrity as Infrastructure

Auctora doesn’t just analyse markets. We help build the ethical and structural foundations they depend upon.

04

Middle East and Africa (MEA) Region Expertise

Our deep understanding of the Middle East and Africa region allows us to provide unique insights and tailored solutions to meet the specific needs of this market.

What our clients say

Trusted by investors, corporates, and advisors who value clarity before commitment, ensuring every market entry into the UAE is informed, verified, and strategically aligned.

“Auctora Analytica provided us with verified financial data and market insight that was instrumental in our UAE investment review. Their structured reports and attention to regulatory accuracy gave us full confidence in our local partnerships.”

Claire Duval

Investment Director

“The team at Auctora Analytica demonstrated an exceptional understanding of the UAE’s energy market. Their due-diligence support and entity verification process helped us move forward with confidence on several key supplier agreements.”

Lukas Reinhardt

Head of Procurement

“We’ve been working with Auctora Analytica on an ongoing basis, using their UAE KYB and monitoring services to keep our regional partnerships compliant and transparent. Their consistency and professionalism make them a valued long-term partner.”

Sarah Whitmore

Regional Development Manager

Insights.

Signals that matter

Our analysts track policy moves, capital flows and market signals across the UAE and GCC, turning verified data into clear actions for investors and operators.